Results-Based Financing

> Download the Results-Based Financing booklet here

What is Results-Based Financing?

.jpg) The Results-Based Financing (RBF) investment programme is a commercial financing facility that became operational in WSTF in December 2014 after the Government of Kenya signed a Grant Subsidiary Agreement with the German Development Bank (KfW) and the World Bank. The grants are provided by the Swedish International Development Agency (SIDA) through the KfW via the Aid on Delivery (AoD) programme for 1.36 million EUR and the World Bank Output-Based Aid (OBA) programme for 11.835 million USD.

The Results-Based Financing (RBF) investment programme is a commercial financing facility that became operational in WSTF in December 2014 after the Government of Kenya signed a Grant Subsidiary Agreement with the German Development Bank (KfW) and the World Bank. The grants are provided by the Swedish International Development Agency (SIDA) through the KfW via the Aid on Delivery (AoD) programme for 1.36 million EUR and the World Bank Output-Based Aid (OBA) programme for 11.835 million USD.

In recognition of the need to reduce grant financing for commercially viable water utilities and in order to introduce a new business model to water financing, the RBF programme is supporting water utilities that are investing in water supply and sanitation improvement projects in the low-income and underserved rural and urban areas in Kenya. The WSPs are able to leverage loans from local financing institutions, which are then subsidised at a percentage of the project cost on attainment of agreed deliverables.

Target clients of the Results-Based Financing

The primary beneficiaries of the projects under the RBF programme that have been reached out of the targeted 150,000 (until 2018) as of June 2016 are a total of 3,645 households or 21,650 people. These are broken down as 16,940 people accessing individual water connections, 4,290 people accessing water kiosks, and 420 people accessing yard taps.

How the Results-Based Financing works

The projects to be implemented by the water utilities are pre-financed with commercial loans from domestic lenders in Kenya on market terms. The loans will support investments linked to the following:

- Construction/expansion of water and sewer networks to reach unserved consumers,

- Rehabilitation/improvement of existing networks e.g. the non-revenue water reduction programme,

- Water and/or sewer connections to households and public points,

- Water and sewer treatment facilities.

After completion of their projects, the water utilities are incentivised through applying one-off subsidies provided under the RBF sub-programmes for up to 60% under the OBA and up to 50% under the AoD programmes.

To facilitate the uptake of the RBF subsidies, the water utilities’ projects are prefinanced with commercial loans from local lenders. The RBF programme is currently working with three commercial banks, namely Sidian Bank, Kenya Commercial Bank (KCB) and Housing Finance, which have access to a 50% guarantee provided by USAID. Other banks, including Equity Bank, Family Bank, GT Bank and Coop Bank, have also been approached by the Water Fund and have shown interest in financing the water utilities under the programme.

Achievements of the Result-Based Financing

RBF commercial loans by local banks

As of June 2016, the RBF programme has facilitated the financing of five projects and reaching cumulative loan disbursements of KES 338.18 million since its creation in December 2014. The commercial facilities are loaned out to interested water utilities at the prevailing market rates. Of the total disbursements to date, the Sidian Bank has contributed 76.5%, followed by Housing Finance (23.5%), while KCB is yet to make a disbursement under the RBF programme.

RBF subsidies by WSTF

The RBF programme has so far disbursed subsidies valued at KES 69.48 million to four projects since inception (Table 12). The AoD programme contributed 62% of the total subsidies while 38% came from the OBA programme.

The 11.835 million UBA grant for the OBA facility consists of 9.5 million USD (KES 950 million) and 2.335 million USD (KES 233.5 million) for implementation support activities while the AoD grant facility for 1.36 million EUR (KES 150 million) is available for AoD subsidies.

Partners

As mentioned before, two categories of partners facilitate the work of the RBF programme:

- Local banks that pre-finance projects with commercial loans: Sidian Bank, KCB and Housing Finance (which have access to a 50% guarantee provided by USAID). Other banks including Equity Bank, Family Bank, GT Bank and Coop Bank have shown interest in financing the water utilities under the programme.

- Partnerships for financing subsidies after the projects are implemented: Government of Kenya, KfW, World Bank, SIDA.

Key elements of the Results-Based Financing success

- The programme is contributing to SDG 6 and Kenya‘s Vision 2030 by ensuring the availability and the sustainable management of water and sanitation for all. It is receiving favourable support from the Government of Kenya through the Ministry of Water and Irrigation, the county governments, water services boards and WASREB who are the stakeholders mandated to provide water supply and sanitation services in low-income and underserved areas of Kenya.

- The ownership of the water and sanitation infrastructure by both the water utilities and the county governments is increasing under the programme.

- The beneficiary water utilities are now fully registered companies under the Kenyan Companies Act and have the capacity to service commercial loans, which can be subsidised under the RBF programme.

Challenges and future perspectives

Challenges

- Lack of viable project proposals: To assist WSPs in developing viable project proposals, the WSTF is providing technical assistance (TA) funding under the RBF programme. The WSPs will procure consultancy services for developing project technical designs, project cash-flows, environmental and social management plans and social connection policies, which are prerequisites for eligibility under the RBF subsidy programme.

- Failure to raise connection fees by household beneficiaries: The failure to raise funds for connections by household beneficiaries is being addressed through the inclusion of at least 60% of the total cost of connections in the commercial loan to be borrowed by the WSPs. The households will then contribute at least 40% of the costs. The beneficiaries are expected to repay the 60% of connection costs borrowed by the WSP through monthly instalments included in their tariffs over an agreed period.

- Increased demand for commercial financing facilities: The RBF programme is noting an increasing demand for the introduction and improvement of water and sanitation services in all 47 counties. This is attributed to population growth, dilapidated infrastructure and physical and commercial non-revenue water. This is resulting in increased demand for commercial financing facilities by water utilities while banks are beginning to understand the water sector.

- Lack of coordination between water utilities and county governments: A number of water utilities are failing to meet the eligibility criteria under the RBF programme due to poor relationships with their county governments. It is a strict requirement that projects to be undertaken by the water utilities are approved by and will receive support from the county governments. Some water utilities are not applying for the RBF subsidies due to this irregularity.

- Slow uptake of commercial financing as an option for WSPs: The majority of water service providers in Kenya are not aware of the terms and conditions of the RBF subsidy programme. To increase awareness of the RBF programme, the WSTF have been undertaking workshops, seminars and open days to reach out to all WSPs in Kenya. The WSTF intends to launch a Call for Proposal under the AoD programme in July 2016 to invite WSP applications under the RBF programme.

Targets

The RBF programme pipeline as of June 2016 has a total of 17 projects with an estimated commercial loans requirement of KES 2.304 billion and a potential subsidy demand of KES 1.241 billion (Figure 8). The target beneficiaries for the OBA are 150,000 by June 2018.

Future perspectives

The RBF programme is a short-term programme that is aiming to achieve the following after its implementation phase.

The TA funding are short term facilities where external consultants are working with water utilities staff and building capacity in developing project proposals and in supervising the projects. It is expected in the near future that the water utilities will be able to undertake these tasks internally, thus becoming autonomous and consequently reducing their over-reliance on external assistance.

The RBF subsidies are meant to stimulate initial financing for the water sector by commercial lenders in Kenya. The subsidies are meant to assist the water utilities to repay their loans while at the same time improving revenue collection from the established projects. It is therefore envisaged that the established projects will result in increased revenue inflows enabling future loan borrowing by the water utilities, which will be repaid using company revenues.

The RBF facilitation in linking water utilities to commercial lenders sets in as an opportunity for commercial lenders to better understand the water sector while, at the same time, the water utilities are now considering borrowing from commercial banks as a future sustainability strategy and moving away from overdependence on traditional grants.

The RBF programme is therefore building confidence in the financial sector to consider the water sector as a viable business sector, where commercial financing can be applied and fully utilised for the advancement of the people of Kenya.

Water and Sanitation Services / Rural Programme

WATER AND SANITATION SERVICES - FINANCING THE UNDERSERVED TARGET COMMUNITIES IN RURAL KENYA

Which Areas Does the Water and Sanitation Services Focus On?

The Water and Sanitation Services (WSS) department is established to enable the development of water services in rural areas considered not to be commercially viable as stipulated in the Water Act, 2016, Section 114 (b), (c). This department is responsible for the effective and efficient design and implementation of WSS programmes, including research activities, emergency and special programmes.

The key implementing agents for identified and approved water and sanitation projects are Water Service Providers (WSPs), Water Users Associations (WUAs), Conservancies, International and Non-Governmental Organisations (INGOs) who are involved in the preparation, planning, implementation and operations of water and sanitation projects. This Department relies upon outsourced support services from the private sector to offer technical support (in terms of ESIA, surveys and project designs). In addition, the County Governments co-finance some of the programmes, ensure coordination and play supervisory roles.

Projects funded under this Investment focus on the poor, underserved communities in Kenya who are viewed as financially unviable and unattractive to the traditional commercial-based service providers or licensees. It focuses on target areas that are water-stressed and that lack investment in water and sanitation facilities.

The WSS investment objectives are as follows:

- Finance to increase access to improved water and sanitation services in rural, underserved areas

- Enhance the capacities of implementing agents by providing technical, advisory and capacity development support

How Does WSS Work?

The WSS supports the County Governments towards increasing water and sanitation access in rural, underserved areas. This has been realised through the signing of Memoranda of Understanding and Implementing Partners’ financing contracts and financing prioritised projects.

The WSS financing mechanisms promote the definition of roles within the sector for good governance through independent oversight and monitoring of resource utilisation. This aspect ensures that fiduciary risks are minimised through effective and efficient monitoring mechanisms, leading to better implementation of water and sanitation projects with respect to value for money.

WaterFund has engaged the services of Quality Assurance Monitors (QAMs) who act as liaison officers and provide oversight, monitoring and quality assurance services.

Water and Sanitation Services Funding Process

WaterFund is a state corporation and mobilises funds from various development partners. The funds are then channelled to various county governments and organisations to support in project planning and implementation. This is done through calls for proposals, depending on the programme design.

WaterFund funding may be restricted and anchored to:

- Thematic focus – water, sanitation and climate change

- Selected counties or targeted communities

- Type of implementing partners

- Funding ceiling

- Project duration

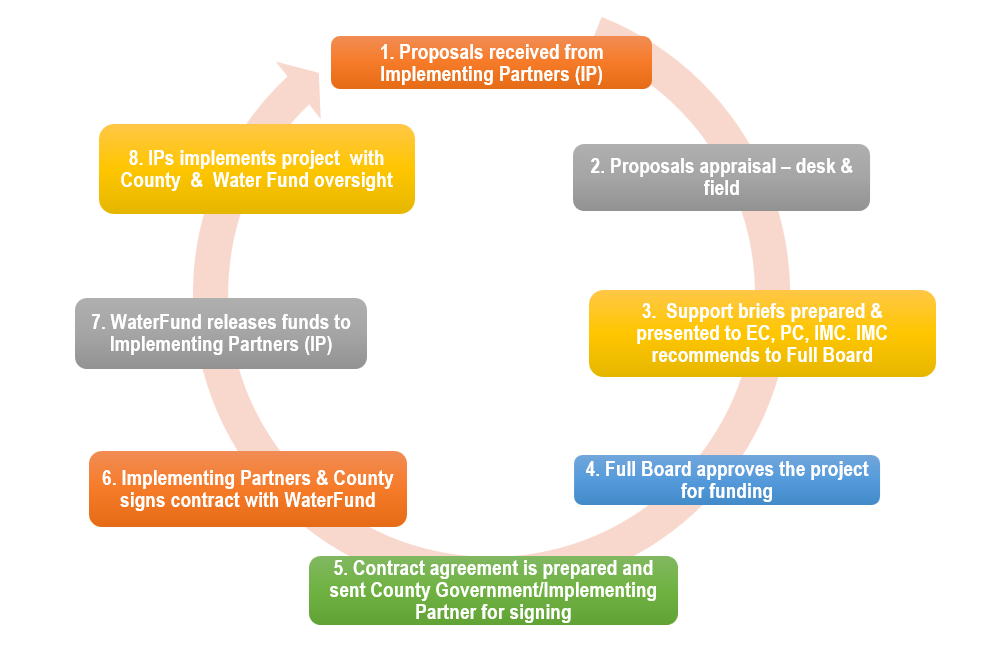

The following figure shows the WSS funding process.

In general, projects will be identified through several schematic processes. However, this may vary according to the programme and the funding sources:

- Information campaign (subject to availability of funds) – advertisement for Call for Proposals will be done through widely circulated media and the WaterFund website. Time period would be provided for clarifications and/or public workshops to explain the proposal guidelines and eligibility criteria.

- Submission of a Proposal Applications – proposals will be received at the headquarters.

- Appraisal of proposal (governance, social, financial, environmental and technical). The appraisal will be twofold: desk and field. Desk appraisal against set appraisal criteria to check viability and appraise the supporting documents, timelines for submission, eligibility of applicants, proof of registration, amongst other requirements. Field appraisal entails assessing project relevance to the proposed community, technical, social and financial feasibility, environmental compliance, operation and maintenance, sustainability and impact and management and governance structures.

- Assessment of proposal after field appraisal (administrative and technical) – the selected projects may further be subjected to administrative and technical appraisal after field appraisal. Issues of concern are appropriateness and completeness of designs and bills of quantities, budgetary contribution, participation, operation and maintenance and sustainability.

- WaterFund four-tier approval process after development of an investment brief, it will be submitted to the Engineering Committee, Project Committee, Investment and Monitoring Committee, before being recommended to the Full Board.

- Full Board - The Board of Trustees make the final approval.

- Financing Contract/Agreement – Final stage includes signing of the Financing Agreement by the concerned parties and WaterFund.

- Capacity building – This involves training of the Implementing Partners on contract, financial, project and procurement management. Additional trainings, e.g., operation and maintenance, are scheduled as implementation progresses.

- Pre-launch & launch workshop – a participatory project launch is done where all project stakeholders are involved. Project information, including objectives, scope and budgets, is shared with the public.

- Project Implementation – Implementation of the project is conducted after identification of a contractor through a competitive process.

- Monitoring of project implementation.

- Internal and External audits are conducted.

- Completion certificates and final completion reports submitted by implementing agents to the Fund.

- Post-evaluation of projects.

- Evaluation of Programme (midterm and end term).

Funding Sources for the WSS Programmes

Since the inception of the WaterFund in 2004, the following Development Partners have supported the Department alongside the Government of Kenya namely: Government of Sweden (Sida), Government of Finland, Royal Danish Embassy/Danish International Development Agency (DANIDA), European Union (EU), African Development Bank (AfDB), United Nations International Children’s Emergency Fund (UNICEF) and World Bank (WB).

The Kenyan Government covers operational costs of the WaterFund, while the Development Partners funds are directed towards the project implementation activities.

Target Counties and Locations

The funding under the WSS programmes targets Counties based on two factors.

- County Selection Criteria that have been developed to identify the marginalised counties based on the following indices:

- KNBS information on poverty, water and sanitation coverage.

- WASREB data on WSPs.

- WRA information on catchments their status and numbers of WRUAs.

- WaterFund analysis of past investments.

- Development partner priorities for marginalised counties e.g. funding targeting Arid and Semi-Arid Land (ASAL) Counties.

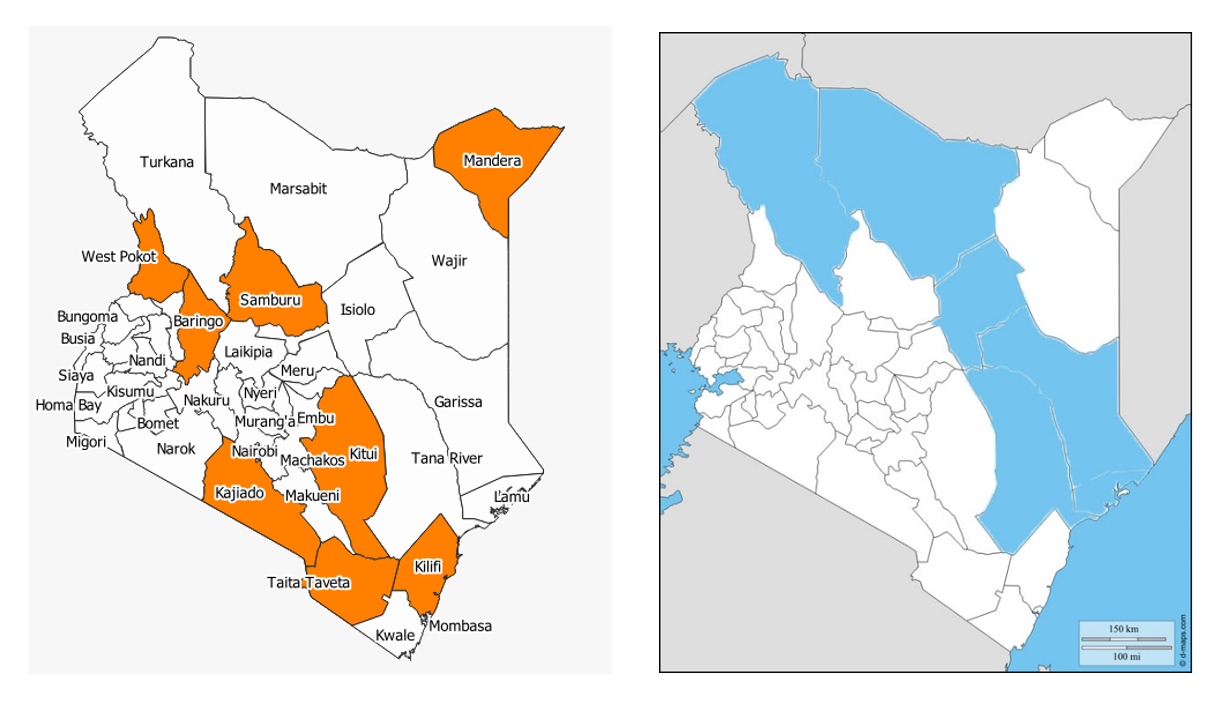

The wound-up and ongoing programme under the WSS Investment targeted 20 Counties based on available funding. These programmes are as follows:

- Kenya Water Supply Programme (KWSP)

- Medium Term ASAL Programme (MTAP) I and II

- Drought Emergency Response Programme (DERP)

- European Union – Support for Horn of Africa (EU SHARE)

- The current Sustainable Management and Access to Water and Sanitation in the ASALs (SWASAP) covering six target counties

- Joint 6 Programme (J6P) - Kwale, Tharaka Nithi, Narok, Migori, Nandi and Laikipia Counties

- Green Growth & Employment Programme (GGEP)

- Water and Livelihood Programme (WLP)

Ongoing Programmes

- Sustainable Management and access to water and sanitation in the ASALs Programme (SWASAP) - Garissa, Isiolo, Lamu, Marsabit, Tana River, Turkana and Wajir Counties.

- Ending Drought Emergency - Climate Proofed Infrastructure Programme (EDE CPIRA) European Union (EU) support targeting Baringo, Kajiado, Kilifi, Kitui, Mandera, Samburu, Taita-Taveta and West Pokot Counties.

WaterFund continues to mobilise more funds and lobby the GoK to ensure that financing is available for more underserved areas and counties in Kenya.

Map of Kenya showing WSS Locations

Achievements of the WSS Programmes

The WSS programmes to date have initiated projects worth KSh 3.74 billion, reaching a population of approximately 1.48 million people under the water and sanitation projects. In total, 386 water and sanitation projects have been funded.

| Programme | No. of Projects | Disbursement (KSh Millions) | Target Population | Funding Source |

| Water | 50 | 323 | 248,168 | GOS/GOF/GOK/EU/DANIDA |

| Sanitation | 36 | 26.98 | 37,050 | GOS/GOF/GOK/EU/DANIDA |

Impact of the WSS Programmes on the Rural Communities

The intervention by the WSS programmes in the underserved and marginalised areas has yielded positive results, as highlighted below:

- Capacity building of sub-grantees, INGOs, WSPs, WUAs and Conservancies on contract, financial and project management, procurement procedures, O&M training.

- Reduced waterborne diseases

- Reduced long trekking distances while searching and fetching water

- Improved and increased water access for humans and livestock

- Improved institutional and community sanitation

- Improved institutional hygiene

WSS Department Financing Principles

The Water and Sanitation Services Department's success is based on several factors:

- Transparent selection of communities/ water utilities, targeting the poorest communities in Kenya.

- Gender Equality and Social Inclusion during planning, implementation and management of water and sanitation projects.

- Climate-proofing infrastructure for resilience and to mitigate against climate change effects.

- Promotion of self-reliance and poverty alleviation to beneficiary communities.

- Support towards community capacity development in the management and operations of water and sanitation.

- Participation, good governance and transparency enhancing accountability.

- County Government engagement and involvement to enhance the sustainability of investments.

Cross-cutting Issues

HIV/AIDS

In the Water and Sanitation Services, emphasis is placed on sensitisation and supporting the affected and infected persons in the community through ensuring they have access to clean water to assist in improving their health status. It is also through the sharing of information and linkages to institutions supporting the affected and infected. Training manuals have been produced for the implementers to sensitise and involve affected persons in the planning and siting of water and sanitation interventions. Brochures from the National AIDS Control Council are also circulated to the beneficiaries during project launch and commissioning. The implementers adhere to the National AIDS Policy.

Gender Equality and Social Inclusion (GESI)

The Water and Sanitation Department is working towards realising gender equality and social inclusion in its programmes. The integration of equity is a critical component in water and sanitation programmes since it gives value to socio-economic differences and diversity. WaterFund advocates for 1/3 gender representation at all decision-making levels and 1/5 inclusion of Persons with Disability and involvement of youth and the aged in all sections of project implementation. This is part of the government's policy to empower the marginalised communities.

Environmental Sustainability

Consideration for climate change effects during planning and designs of projects by promoting adoption of green technologies such as gravity supplies, use of solar and wind power energy for pumping schemes; development of climate-proofed infrastructure – water storage facilities such as water pans, djabias, berkads, rain water harvesting tanks and using technology e.g. smart meters and leakage detection to improve water use efficiency and reduced non-revenue water.

Pictorials

Composite filtration unit (CFU) in Sirimon water project, Laikipia County

Mangrove restoration in Lamu County

Kathwana water project treatment works in Tharaka Nithi County

> For success stories on our Programmes, including Water and Sanitation Services / Rural Programmes, explore our stories here

Urban Investments

> For success stories on our investments, including Urban Investments, explore our stories here

What is the Urban Investments?

.jpg) The Urban Investments through its Urban Projects Concept (UPC) was established in 2007 to respond to the specific water and sanitation challenges of urban low-income settlements in Kenya. There are approximately 2,000 low-income areas in the country with an estimated total population of close to eight million. These low-income areas, which are a mixture of unplanned informal settlements and planned low-income residential areas, have inadequate water supply and sanitation.

The Urban Investments through its Urban Projects Concept (UPC) was established in 2007 to respond to the specific water and sanitation challenges of urban low-income settlements in Kenya. There are approximately 2,000 low-income areas in the country with an estimated total population of close to eight million. These low-income areas, which are a mixture of unplanned informal settlements and planned low-income residential areas, have inadequate water supply and sanitation.

The portfolio of the urban investments has grown over time and today it comprises of two components:

- Urban Projects Concept (UPC) was developed in 2007 to respond to the water and public sanitation challenges of urban low-income areas

- Upscaling Basic Sanitation for the Urban Poor (UBSUP) was initiated in 2011 to respond to household/ plot level sanitation challenges

The Urban Investments’ objective is to provide technical and financial support for water and sanitation projects in low-income urban areas. In addition, it focuses on:

- Improving public health,

- Contributing to the improvement of urban livelihoods,

- Reducing unaccounted-for water,

- Building capacity at water utility level,

- Ensuring that low-income areas are perceived as a business opportunity.

Target clients of the Urban Investments

The Urban Investment Programme primarily targets the urban poor living in both planned and unplanned low-income areas. The projects are implemented through registered water utilities, the WSPs, throughout the country. Besides implementation, the WSPs are responsible for the management of project funds as well as for the successful and sustainable operation of the project.

How the Urban Investment Programme works

The Urban Investment Programme is enabling the WSPs to extend their formalised services to the unserved and underserved urban poor living in low-income areas by financing projects that incorporate simple, cost-effective and sustainable technologies. The Water Fund provides various forms of support to water utilities, urban communities and other stakeholders including:

- Funding for project proposals that address the urban poor with improved water supply and sanitation services,

- Data on almost all urban low-income areas in the database MajiData, which facilitates the preparation of project proposals by the water utilities,

- Online toolkits that assist the water utilities, the communities involved and other stakeholders to plan, implement and operate water supply and sanitation schemes in low-income areas,

- Technical standards, drawings and bills of quantities,

- Regular workshops for water utilities enabling the members of staff of the providers to share experiences and learn from challenges faced and best practices,

- Visualisation (online) of all implemented projects with a focus on project operation.

The financing of the projects in the Urban Investments programmes, including both UPC and UBSUP, with funds from different development partners, is done through Calls for Proposals (CfP). With every launch of a Call for Proposals, the urban water utilities are invited to prepare and submit proposals for the improvement of water supply and sanitation in the low-income areas within their service area. WSTF then does the appraisal and the awarding of project proposals. The CfP approach encourages competition and an efficient allocation of funds.

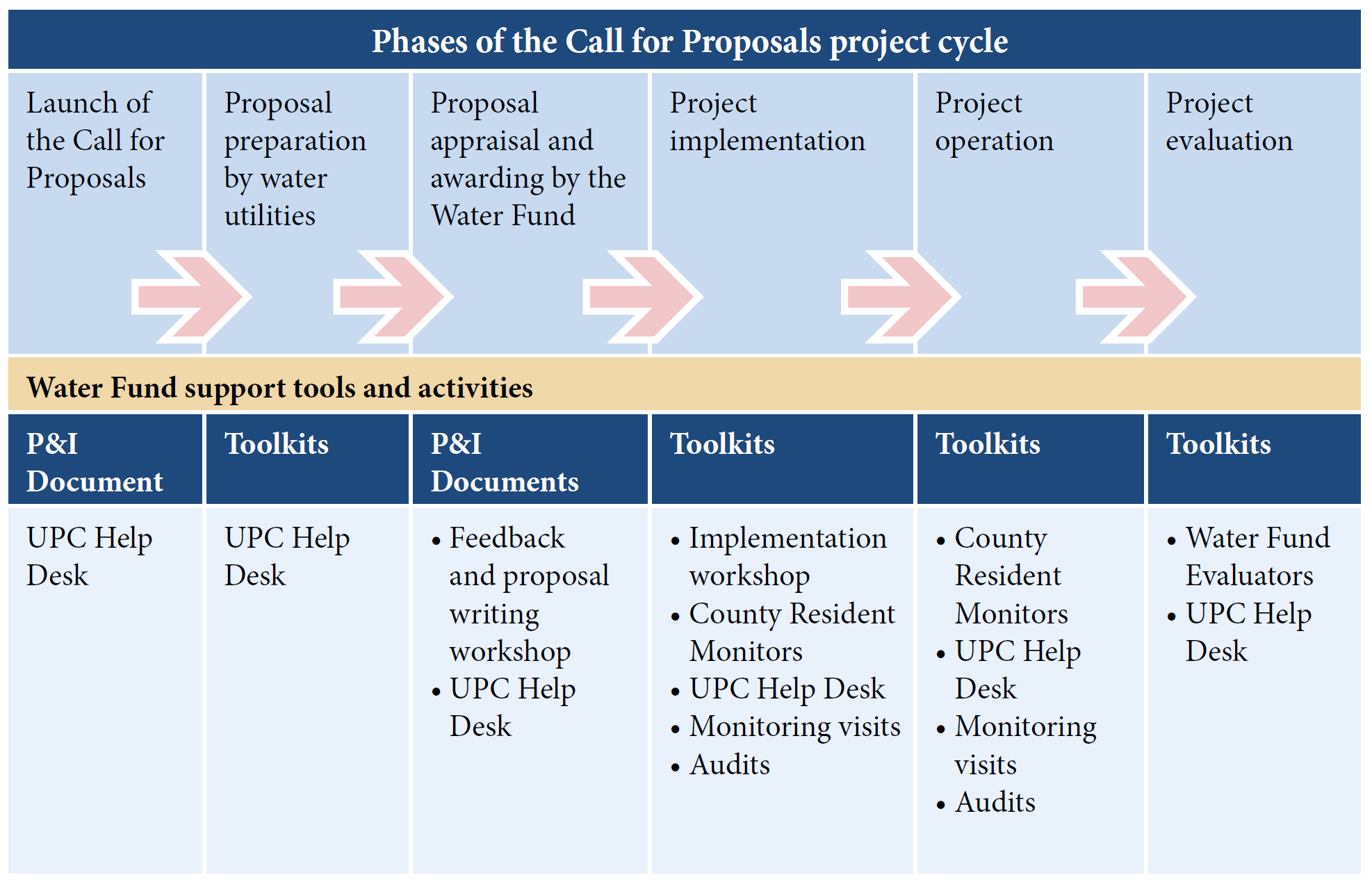

The figure below shows the various support tools, measures and activities WSTF provides during the various phases of a Call for Proposals project cycle.

The current set of technologies being implemented range from water kiosks and yard taps to water meters (pre-paid and post-paid), network extensions and public sanitation facilities. The Urban Programme is continuously working on extending the technical options. UBSUP has developed a set of household/plot level sanitation options and onsite wastewater treatment facilities.

Development partners

Since 2008, the Urban Investment has been financed by the European Union together with the German Development Bank (KfW). The German Gesellschaft für Internationale Zusammenarbeit (GIZ) started its cooperation with WSTF through the Water Sector Reform Programme in 2007. Their main role at WSTF is the provision of technical support for the Urban Investments, including UBSUP.

In July 2011, the Bill & Melinda Gates Foundation (BMGF) partnered with the WSTF, KfW and GIZ to roll out the five-year urban sanitation programme UBSUP that aims to provide sustainable sanitation services to an additional 400,000 people in Kenya’s urban low-income areas. The Investment specifically targets the populations in the “sanitation hotspots” — the informal and formal, unplanned and planned, low-income urban settlements where child mortality is twice the national average.

In 2013, KfW supported the Water Fund to implement Aid on Delivery (AOD) which provides a 50% subsidy for commercial loans to WSPs for water and sanitation projects. The World Bank has partnered with the Water Fund to implement Output-Based Aid (OBA) which provides a 60% subsidy for commercial loans to WSPs who in turn will increase connections to low-income areas.

Achievements of the Urban Investments

For the people living in urban low-income settlements, the Urban Investment interventions have brought better health for children and adults, and improved living standards. A survey carried out to assess the impact of water kiosks showed overwhelming acceptance by the residents, who reported improved access to water, a drop in waterborne diseases, improved household hygiene, improved security when fetching water, and an increase in productive and leisure time thanks to less time spent on water duties.

Since 2007, KES 3.6 billion has been invested by the Urban Investment. The impact of these investments is manifold: Approximately two million urban Kenyans have been reached with improved water supply and public sanitation services.

The outputs of the projects include:

- Construction of 646 water kiosks,

- Construction and rehabilitation of 2,013,865 km of pipeline,

- Construction of public sanitation facilities, water storage tanks, yard taps and installation of pumping units,

- Successfully piloted prepaid yard taps with the Nakuru Water and Sanitation Services Company,

- Subsidy provision for household sanitation and commercial loans.

Additional impact has been achieved such as capacity building of water utilities, the launch of MajiData and the development of new technologies.

The Urban Investment successfully piloted the Up-scaling Basic Sanitation for the Urban Poor (UBSUP) programme in three water utilities. The programme aims to improve sanitation at household and plot level. This has been upscaled countrywide and so far 20 water utilities are implementing the 1st Call for Proposals for UBSUP. Marketing of improved SafiSan toilets has been done and solutions along the entire sanitation value chain have been supported. UBSUP aims to reach up to 400,000 people with adequate sanitation.

Key elements of the Urban Investments’ success

A number of factors contribute to the success of the Urban Investment:

- Transparent procedures and funding criteria

- Competitive allocation of funds through Calls for Proposals (“value for money”)

- Embedment in the sector framework: alignment to sector strategies

- Use of local institutions for implementation (only registered water utilities)

- Comprehensive approach: financing + supervision + capacity building of local implementers

- “Going the last mile” with innovative low-cost water and sanitation solutions

- Measuring impact through tailor-made baseline surveys and information systems, and long-term performance monitoring of utilities

- Capacity building of the water utilities to enable them to implement the projects

- Repetition of standardised project cycles allows for continuous improvement

- Use of the county resident monitors in monitoring of the projects

Challenges and future perspectives

Some of the challenges being faced by the Urban Investments include:

- Inadequate funds to finance all the proposals that meet the criteria for funding,

- Slow implementation of the projects by the water utilities. The water utilities are not able to complete the projects within the given periods,

- Initially slow uptake of the UBSUP projects,

- Audit issues contributed to unquestioned costs that the water utilities can address but that were not given any priority.

Future prospects include the opportunity to work with the counties in supplying water and sanitation in the underserved areas of Kenya. Also, there are innovation opportunities for project implementation, data collection and reporting.

> For success stories on our investments, including Urban Investments, explore our stories here

Water Resources Investments

What is the Water Resources Investment?

.jpg) The Water Resources Investment (WRI) commenced in 2008, motivated by the fact that a big part of the population was not connected to the water network, making dependence on natural water resources inevitable. Consequently, the conservation of catchment areas and the protection of water resources was a necessity.

The Water Resources Investment (WRI) commenced in 2008, motivated by the fact that a big part of the population was not connected to the water network, making dependence on natural water resources inevitable. Consequently, the conservation of catchment areas and the protection of water resources was a necessity.

The Water Resources Investment is mandated to monitor, conserve and manage the water resources and catchment areas for sustainable economic development in Kenya. This is done through appraising and funding Water Resources Users Association (WRUA) and Community Forest Association (CFA) proposals in their Water Resources Management. WRUAs, through the implementation of Sub-Catchment Management Plans (SCMPs), manage and conserve the water resources within their respective sub-catchments. CFAs on the other hand, through the implementation of their respective Participatory Forest Management Plans (PFMPs), assist in rehabilitation and increase of the forest cover, the major sources of rivers in Kenya.

The objectives of the Water Resources Investment are to:

- Improve the quantity and quality of water resources for enhanced livelihoods,

- Improve the ability of the catchment and riparian areas to provide hydrological services,

- Ensure the governance of water resources by promoting stakeholder participation in water resources management,

- Improve compliance to protect water resources by promoting stakeholder participation in water resources management,

- Develop well governed and self-reliant WRUAs.

Development Partners

The Water Resources Investment currently has three programmes financed by 1) The governments of Finland and Sweden, 2) The International Fund for Agricultural Development (IFAD) and 3) Denmark (DANIDA). The Kenyan government covers operational costs of the Water Fund while other funds support the development of projects depending on the funding agreements of specific partners. Within the framework of devolution, the development partners are now accessing the beneficiaries through the counties.

The governments of Finland and Sweden support WRUA activities in the six counties of Kwale, Laikipia, Migori, Nandi, Narok and Tharaka Nithi in a programme referred to as J6P.

DANIDA, on the other hand, supports WRUA activities in the six counties of Garissa, Isiolo, Lamu, Marsabit, Tana River and Wajir in a programme known as Medium Term Arid and Semi-arid lands Project (MTAP). So far DANIDA has supported the programme in two phases, MTAP I & II.

The International Fund for Agricultural Development (IFAD) supports a programme in the six counties of Upper Tana Catchment known as Upper Tana Natural Resources Management Project (IFAD-UTaNRMP). This covers both CFAs and WRUAs in the Mount Kenya and Aberdares’ regions of Tana Catchment. The beneficiary counties are Embu, Kirinyaga, Meru, Murang’a, Nyeri and Tharaka Nithi.

A total of 17 counties are currently benefiting from the Water Fund’s support (out of which one county, i.e. Tharaka Nithi, is benefiting from two programmes).

Prior to county devolution, 312 WRUA projects had been funded and the lessons learnt have been used to improve the Water Resources Investment Unit.

How the Water Resources Investment works

The Water Resources Investment finances activities based on proposals by the WRUAs and the CFAs. The WRUAs channel their proposals through the Water Resources Management Authority while the CFAs channel theirs through the Kenya Forest Service to WSTF within the Water Resources Users Association Development Cycle (WDC). WRUAs that have identified relevant water resource management issues can plan and come up with proposals for funding from the Water Fund. Any funding is preceded by signing an MOU with the Water Fund to govern the manner in which the grant is managed by the WRUA and to clearly stipulate the roles and responsibilities.

The proposals are assessed through a number of criteria, of which one is the degree of degradation of the concerned area that is classified as alarm, alert or satisfactory. Others include the poverty index, access to quality water services and sanitation coverage. The financing of WRUAs through WSTF happens at various categories from level 1 to level 4. After one level is implemented, accounted and audited, the WRUA becomes eligible for the next level of funding. WSTF's county resident monitors are responsible for conducting a regular monitoring of the activities.

The levels are as follows:

- Level 1 costs KES 1.5 million: Capacity development and development of the Sub-Catchment Management Plans (SCMPs)

- Level 2 costs KES 5 million: Activities from the SCMP

- Level 3 costs KES 10 million: Activities from the SCMP

- Level 4 costs KES 30 million: Activities from the SCMP

The Water Resources Investment is specifically aimed at capacity building of the WRUAs, development of the sub-catchment management plans (SCMPs) or participatory forest management plan (PFMP), and implementation of the SCMP and PFMP activities. To begin with, every WRUA needs to develop an SCMP whereas the CFAs are supposed to develop a PFMP.

Capacity building of the CFAs and development of the PFMPs is done by the Kenya Forest Service (KFS). The financing of CFAs through WSTF happens at various categories but with a ceiling of KES 2 million.

Achievements of the Water Resources Investment

The Water Resources Investment has registered success in a number of areas. In the financial year 2015-2016, the Water Resources Investment funded a total of 61 WRUAs and 18 CFAs at a disbursement of KES 161,389,682 and KES 23,103,332.20 respectively. The total cost of the Water Resources Investment was KES 184,493,014.20.

Financing of WRUA and CFA activities countrywide has resulted in environmental sustainability and increase in forest cover through rehabilitation. This was aimed at achieving the Millennium Development Goals’ target No. 7 and realising the Vision 2030 goals.

Through the Water Resources Users Association Development Cycle, the Water Resources Investment has created awareness about catchment conservation and protection of natural water resources within communities countrywide. Furthermore, the Water Resources Investment has given birth to centres of excellence in each of the six Water Resources Management Authority catchment regions to act as model WRUAs to other upcoming WRUA groups within the specific regions.

The key elements of the Water Resources Investment’s success

The Water Resources Investment’s success is based on a number of factors. One important issue is that the lessons learnt from previous projects are used to improve the activities. Furthermore, the Water Resources Investment recognises a number of cross-cutting issues that assure the success of the activities. Mainstreaming of livelihood components, as well as gender and social inclusion in the SCMP activities, ensures sustainability of WRUA activities and thus conservation and protection of the catchments.